Ivory Coast Listed Among High-Risk Countries for Money Laundering Issues.

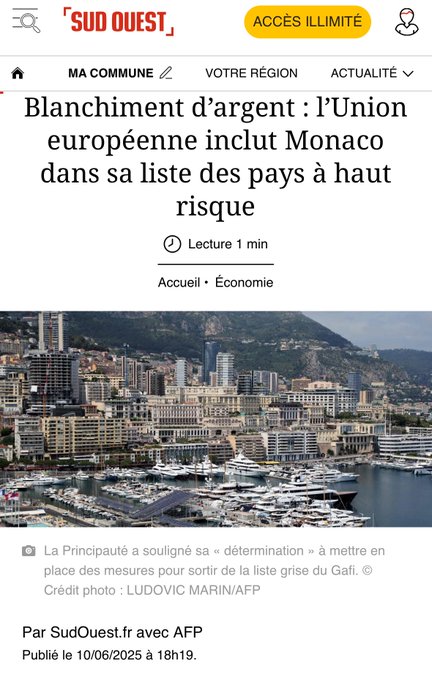

The European Commission has identified Ivory Coast as one of the high-risk countries facing challenges related to money laundering.

Alongside Monaco, the Commission has included Algeria, Angola, Kenya, and Laos in the list of countries subject to increased monitoring due to the risks associated with money laundering activities..

Ivory Coast’s inclusion in this group raises concerns about the effectiveness of its anti-money laundering measures and the potential impact on its financial integrity.

The country’s economy, heavily reliant on sectors like agriculture and mining, could face reputational damage if not adequately addressing these issues.

The European Commission’s decision reflects a broader global effort to combat illicit financial flows and strengthen the integrity of the financial system..

The identification of Ivory Coast as a high-risk country highlights the need for enhanced vigilance and regulatory measures to prevent money laundering activities within its borders.

The country’s authorities must work closely with international partners to improve transparency, strengthen regulatory frameworks, and enforce anti-money laundering laws effectively.

Failure to address these challenges could lead to severe consequences, including sanctions and restrictions on financial transactions with other countries..

Moving forward, Ivory Coast must prioritize efforts to enhance its anti-money laundering capabilities and demonstrate a commitment to combating financial crimes.

By implementing robust regulatory mechanisms, conducting thorough risk assessments, and fostering international cooperation, Ivory Coast can mitigate the risks associated with money laundering and safeguard its financial system’s integrity.

The country’s proactive stance in addressing these challenges will be crucial in maintaining trust and credibility in the global financial community..

Leave feedback about this