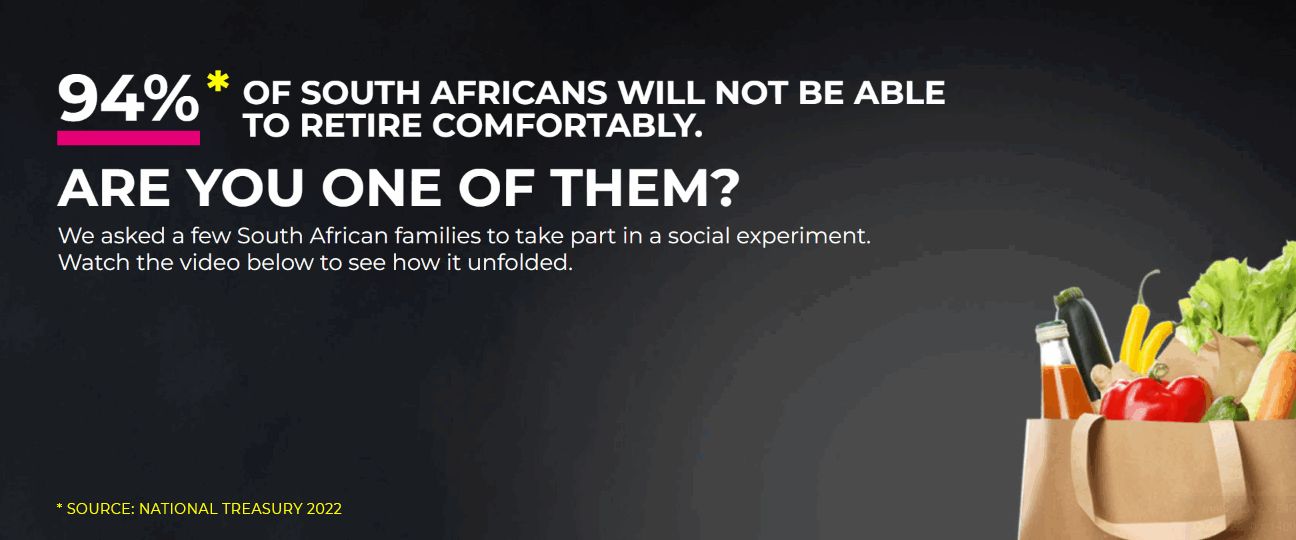

Are you part of the mere 6% of South Africans who may retire comfortably, receiving about 75% of your final salary? This statistic sheds light on a looming retirement crisis in the country. Many individuals are not saving enough or starting early with their retirement plans.

“Only 6% of the South African population can retire independently,”

shares Andre Tuck from 10X Investments. This revelation mirrors a concerning trend seen in various reports highlighting the lack of readiness among citizens when it comes to retirement.

The road to a secure retirement is paved with proactive planning and disciplined savings habits. However, many individuals fall short in these areas, leading to financial uncertainty as they approach their golden years.

Planning for retirement should start early on in one’s career, ideally in the 20s or 30s. Setting clear retirement goals and consistently monitoring progress are crucial steps that many overlook due to the perception that retirement is too far off to worry about presently.

According to Tuck, accumulating savings of at least R7.5 million by age 63 is a recommended starting point for those aiming to retire comfortably. However, merely amassing this sum is not enough; adherence to sound financial principles throughout retirement is equally essential.

A commonly held benchmark suggests withdrawing around 4% annually post-retirement for sustainable income levels. Achieving this balance requires meticulous budgeting and prudent financial management even after exiting the workforce.

It’s vital not only to focus on accumulating wealth but also on optimizing costs associated with investments and financial products. Understanding fees, effective annual costs (EAC), and making informed decisions regarding fund allocations can significantly impact long-term financial well-being.

Tuck emphasizes the importance of seeking professional financial advice, especially considering the complex landscape of retirement planning and investment options available. Engaging with knowledgeable advisors can provide valuable insights into navigating these waters effectively.

Financial literacy plays a pivotal role in ensuring a secure future post-retirement. Educating oneself about various investment vehicles, fee structures, and tax implications empowers individuals to make informed choices aligned with their long-term goals.

As individuals strive towards financial security in retirement, continuous learning and adaptation become key pillars supporting a stable economic foundation for life after work. By staying informed, seeking expert guidance, and remaining proactive in financial matters, one can better prepare for a comfortable retirement journey ahead.