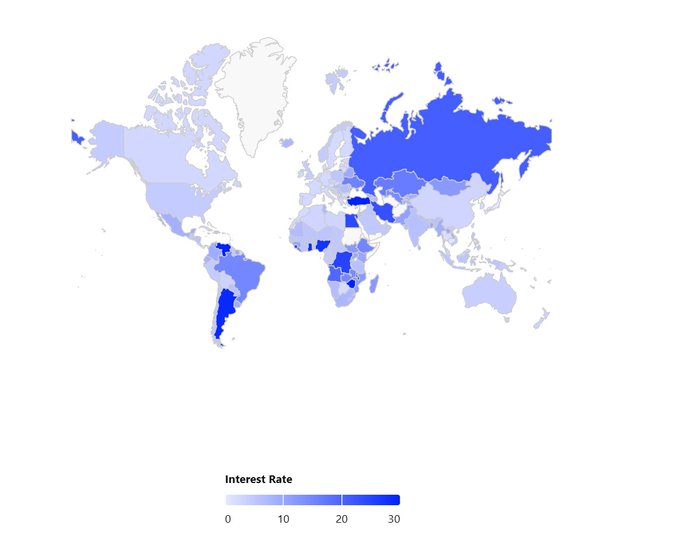

Interest rates across various African countries have been revealed, shedding light on the economic conditions in these nations.

Venezuela leads with an astonishingly high interest rate of 59.29%, followed by Turkey at 46%, and Zimbabwe at 35%.

These figures reflect the financial challenges these countries are facing, with high interest rates indicating economic instability and potential issues with inflation..

In Africa, Ghana stands at 28%, Nigeria at 27.5%, Malawi at 26%, Congo at 25%, and Sierra Leone at 24.75%.

These rates are crucial indicators of the countries’ monetary policies and their efforts to control inflation.

Countries like Egypt, with a rate of 24%, and Angola at 19.5%, are navigating economic landscapes that require careful management to ensure sustainable growth and stability..

The interest rates in Haiti (17%), Kazakhstan (16.5%), Ukraine (15.5%), and Brazil reflect diverse economic challenges faced globally.

These rates influence borrowing costs, investment decisions, and overall economic growth prospects.

The data underscores the importance of monitoring interest rates as a key economic indicator for assessing the health of a country’s economy..

As these interest rates continue to fluctuate, countries will need to closely monitor and adjust their monetary policies to ensure stability and growth.

High-interest rates can deter investment and economic activity, while excessively low rates may lead to inflationary pressures.

The future outlook for these countries will depend on their ability to strike a balance that promotes sustainable economic development and financial stability..

Leave feedback about this