As mobile banking adoption surges across Nigeria, users are clamoring for faster and simpler ways to manage their money seamlessly, without the hassle of switching apps or dealing with clunky interfaces. Enter Xara, a revolutionary WhatsApp-based AI assistant designed to transform the banking experience in the region.

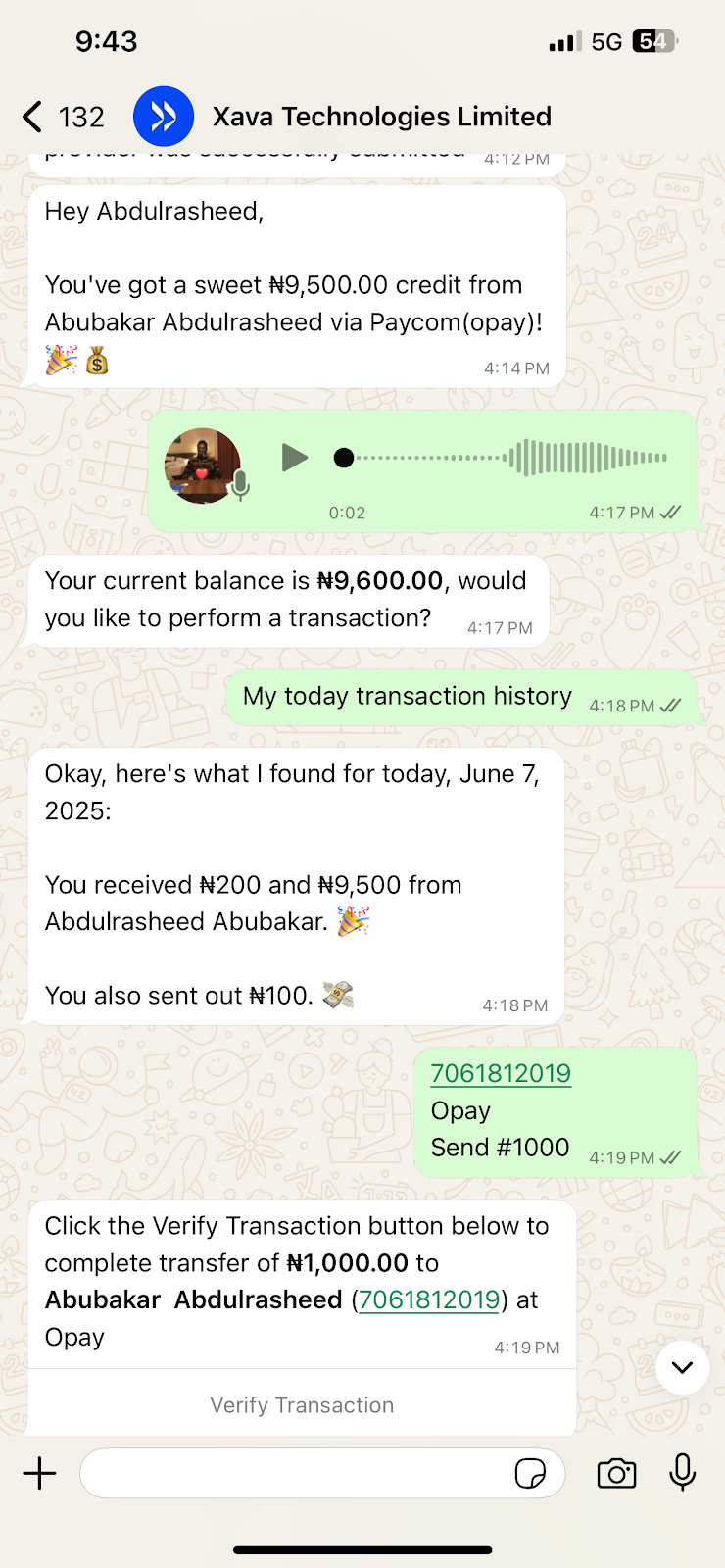

Created by Nigerian software engineer Sulaiman Adewale, Xara is a multimodal artificial intelligence banking bot that made its debut in June. The bot operates entirely within WhatsApp, a platform utilized by 95% of Nigeria’s 31.6 million social media users. Adewale’s vision was to provide a banking solution that is inclusive and user-friendly, tapping into the widespread usage of WhatsApp even among older demographics.

Xara’s approach differs from other fintech offerings in Nigeria by focusing on eliminating friction and enhancing existing user behaviors. By leveraging the same technology behind tools like ChatGPT, Xara is equipped to handle a range of financial tasks, from sending money to analyzing spending patterns, all through natural language interactions.

One of Xara’s standout features is its ability to understand and process transactions using images, voice notes, and text inputs. Its training on Nigerian speech patterns, coupled with a keen focus on local languages like Hausa and Yoruba, sets it apart in catering to the diverse linguistic landscape of the country.

With over 10,000 users onboarded within its initial weeks and transactions totaling over ₦135 million, Xara has quickly gained traction in the Nigerian market. The bot’s convenience and ease of use have resonated with users like Stella Adeboye, a server at Kilimanjaro restaurant in Ilorin, who sees the potential for seamless payments and improved customer experience.

Despite its early success, concerns about data security have been raised by users like Babatunde Hassan. Adewale assures users that Xara prioritizes privacy by utilizing WhatsApp’s end-to-end encryption and implementing additional security measures such as optional PIN authentication.

Looking ahead, Adewale envisions Xara expanding beyond Nigeria to other African countries where WhatsApp is prevalent, aiming to revolutionize the fintech landscape. By integrating services such as savings plans, utility payments, and even e-commerce functionalities, Xara aims to become a comprehensive financial assistant for users across the continent.

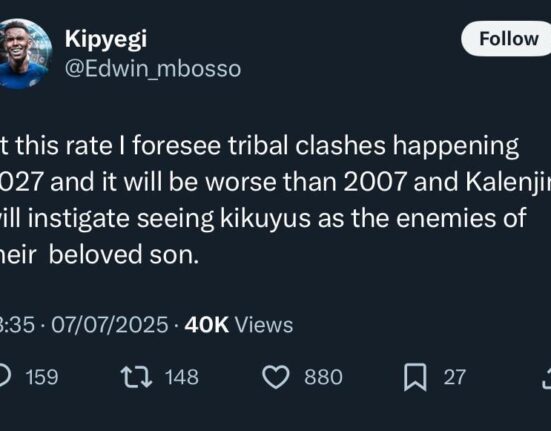

Financial analyst Victor Daniel sees Xara as a promising tool for enhancing financial inclusion, particularly by simplifying payment processes and addressing barriers like technical complexity and fraud concerns associated with QR code payments. The potential for Xara to streamline banking services and empower users in underserved communities underscores its significance in driving economic empowerment and digital transformation.

As Xara continues to evolve and innovate, its impact on the fintech sector in Africa could be transformative, offering a glimpse into a future where banking is as easy as chatting with a friend.

Leave feedback about this