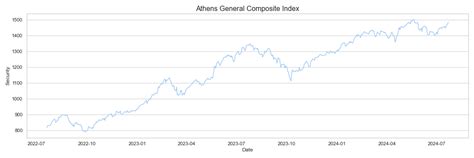

Greece’s financial landscape witnessed a remarkable uptick as the Athens General Composite index surged by 0.41% to achieve its highest level in five years, drawing attention to a spectrum of sectors that contributed to this market upswing.

In a vibrant display of economic vitality, the country’s Construction, Travel, and Banking industries notably spearheaded the positive momentum, igniting optimism among investors and market enthusiasts alike.

Market Highlights

The session unveiled Metlen Energy & Metals AE (AT: MYTr) as a standout performer, clinching a substantial 2.79% increase to close at 33.92 points. Similarly, Piraeus Port (AT: OLPr) made significant strides with a 1.94% rise, reaching 28.95 points by the day’s end. Meanwhile, National Bank of Greece SA (AT: NBGr) demonstrated robust growth, ascending by 1.80% to settle at 8.48 points during late trading hours.

Conversely, Elvalhalcor Hellenic Copper and Aluminium Industry SA (AT: ELHA) experienced a decline of 3.45%, closing at 2.10 points as one of the session’s underperformers. Papoutsanis Industrial and Commercial of Consumer Goods SA (AT: PSALr) faced a similar fate with a dip of 2.39%, ending at 2.45 points while HELLENiQ ENERGY Holdings SA (AT: HEPr) registered a decrease of 2.34%, concluding the day at 7.52 points.

Market Analysis

Expert analysts attribute this market surge to a combination of favorable factors ranging from sector-specific developments to broader economic indicators that have bolstered investor confidence in Greece’s financial prospects.

The prevailing bullish sentiment reflects not only the resilience but also the adaptability of Greek markets amidst evolving global dynamics and regional challenges.

This positive trajectory underscores the country’s potential for sustainable growth and investment opportunities across various sectors.

Commodities Performance

Beyond equities, commodities trading showcased intriguing dynamics with Gold Futures for February delivery experiencing a moderate decline of 0.78%. In contrast, Crude oil prices for March delivery witnessed a more pronounced downturn with both WTI and Brent oil contracts falling by around1-2%.

These fluctuations underscored the intricate interplay between geopolitical events, supply-demand dynamics, and market sentiment shaping commodity prices on an international scale.

Currency Trends

Currency markets exhibited notable shifts as EUR/USD saw an uptick whereas EUR/GBP remained relatively stable compared to previous sessions.

Simultaneously,the US Dollar Index Futures displayed marginal weakening trends during trading hours,

Such currency movements reflect not just local economic conditions but also broader macroeconomic forces influencing global exchange rates in an interconnected financial ecosystem.

Investors keen on currency trading are advised to stay abreastof these trends for informed decision-making strategies in forex markets amid fluctuating exchange rates.

With evolving market landscapes reshaping investment horizons worldwide,Greece’s recent stock market performance serves as both an indicatorand influencerinthe intricate tapestryof international finance.

By navigating through these dynamic shiftsand understanding their implications on diverse asset classes including stocks,

commodities,and currencies,

investors can position themselves strategicallyto leverage emerging opportunitiesacross differentmarketswhile mitigating associated risks effectively.

This continuous explorationand adaptationto evolvingfinancial climates is essentialfor maximizingportfolio returnsand ensuring long-terminvestment successin an ever-changingglobal economy.

Leave feedback about this